Introduction

MakerDao is an advanced cryptoasset protocol that aims to facilitate a truly decentralized stablecoin. Various stablecoin protocols already exist (USDT, USDC, GUSD, TUSD, etc.) but most of these systems fall under the “custodial” category where for each $1 of token unit in existence, $1 of reserve cash is parked in some corresponding bank account. While these centralized models currently make up the majority of stablecoin demand, they operate with inherent risks related to custody, censorship resistance and encroaching regulation and scrutiny. The objective of the MakerDao protocol is to establish a stablecoin system that, similar to bitcoin, is facilitated not on trust in a central organization, but is decentralized, censorship-resistant and non-custodial in nature.

According to protocol documentation, the MakerDAO system “achieves this stability through a combination of external market forces, complementary internal economic incentives, and policy tools controlled by MKR token holders.” In this report, we unpack these forces to demonstrate how the system is able to successfully maintain its peg. In addition, this report details a valuation analysis and model for the MKR governance token.

Overview

We can think of the MakerDAO system analogous to a pawn brokerage. In a high level overview, customers enter the pawnshop with some collateral of value, looking to take out a loan against said collateral. If the broker finds the collateral satisfactory and agrees to issue a loan, a duration term is established, i.e. the future date at which the customer will need to pay back the principle. In exchange for the opportunity cost of his capital, the pawnbroker will also demand an interest payment to be paid at the end of the loan term.

The customer is now free to use the cash proceeds from the loan as he pleases. They might choose to pay off outstanding bills, allocate into an investment opportunity etc. As the duration reaches maturity, the customer will need to pay down his outstanding balance (principle + interest). If he does so successfully, the collateral is returned, and both parties walk. If he fails to do so in time, the collateral is seized by the broker and sold off to recoup the loan. Typically, the loan the merchant is willing to extend to the customer falls well below the market value of the collateral. This provides a margin of safety in the event of a default, as the merchant will have to expend time, resources and potential slippage liquidating the collateral in order to be re-compensated.

Merchants will vary their loan amount/interest rate depending on the quality of collateral the customer brings to the table. Liquid collateral like an iPhone, camera or tablet will have less resale risk than an antique teapot.

Collateralization

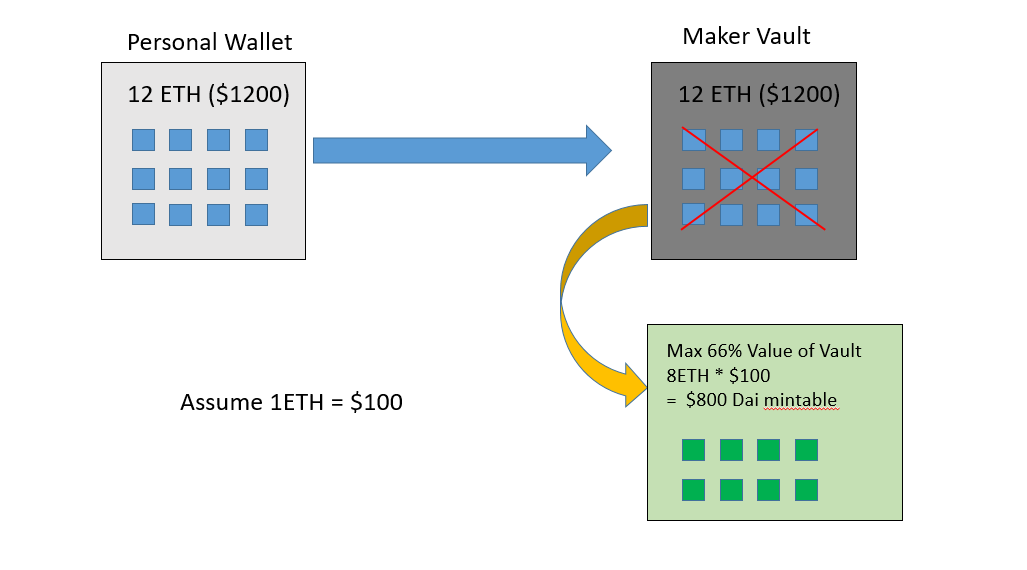

MakerDAO is a protocol that operates like a decentralized form of pawnbrokering. Users can lock up various crypto collateral (ETH, BAT, USDC, etc.) by sending the token on-chain to an escrow account, creating a “vault”. When a vault is initiated, that underlying crypto collateral is frozen and no longer accessible. Simultaneously, a new token called Dai, whose value is soft pegged to $1, is spawned by the smart contract and allocated to the vault’s creator. An important factor to note is that the MakerDao system always requires overcollateralization of the loan. This overcollateralization ratio varies from asset to asset depending on risk profile, but typically falls in the range of 150% minimum threshold. Meaning, if you were to deposit $150 of crypto collateral, the most Dai (aka debt) the system would ever allow you to mint would be 100 Dai. This makes sense intuitively: the pawnbroker isn’t going to give out a $150 loan to a customer who pawns a $100 iphone, or else they’d just run off with the money. They won’t even want to give out a $100 loan, because they take on considerable liquidation risk in the event of a default.

Think of this “peg” model like 2 identical flashlights: one has batteries, the other does not. Without the batteries, the flashlight is an empty shell, but with batteries, it possesses value and is fully functional. We can shift the batteries around from system to system, but they cannot both function simultaneously. Collateral locked in a vault is like the original flashlight whose batteries have been removed and inserted into the alternative model. When we get tired of using the alternative model, we can remove the batteries and replace them back inside our original.

Referencing the above graphic, if I own $800 of Dai, I know that at some earlier time point when the vault was constructed, at least $1200 of ETH deposited. This $400 (minimum) overcollateralization buffer serves as a margin of safety that the Dai will always remain backed. I also have assurance that if the ETH collateral ever falls below that $1200 margin tab, the MakerDao system will immediately kick in behind the scenes, and through various economic and system incentives described below, ensure that there will always be $800 collateral backing that $800 Dai. This lies in contrast to the USDC model where there is no overcollateralization buffer, nor any system redundancy: if the $’s parked in the Coinbase bank vault are seized, frozen or stolen, there is no automated recourse or mechanism to ensure the 1:1 peg remains.

Here's where things get a little tricky: one of the major differences between MakerDao and pawnbrokering is that collateral in MakerDAO is quite variable, while pawn brokering is relatively fixed. An asset like an iPhone typically isn’t going to fluctuate much in price from day to day. One could argue that natural depreciation exists (i.e. if a new model comes out, it pushes down the price of earlier versions), but the fixed duration of the loan tends to mitigate these issues, or at minimum, allows the broker to account for such risk when deciding on the term of the loan, and what interest rate to charge. Crypto collateral is highly volatile and can fluctuate considerably in a short window. Suppose someone creates an initial vault, depositing $300 ETH collateral, minting $100 Dai against it. The ETH market crashes, and the corresponding events ensue:

At time T3 the vault has fallen below its minimum 150% collateralization ratio (this ratio varies from token to token depending on its risk profile) and is now subjected to a process called liquidation. During liquidation, the MakerDao system involuntarily liquidates the underlying crypto collateral held in the creator’s vault. This process is analogous to the pawnbroker selling off the iphone if the borrower fails to return the loan in time.

This leads us into the 2nd fundamental difference between the MakerDao protocol and the pawnbroker analogy: duration. Pawnshops typically require customers to return the loan after a designated period of time, lest they seize the collateral. Maker on the other hand has no theoretical limit on the duration in which a vault can remain open. Rather, a vault’s crypto collateral is seized if the USD value of that collateral falls below its specified minimum ratio.

Dai

An important factor to point out is that once Dai has been issued, it is impossible for the system to repo that Dai from its owner; the system only has access to the collateral tied up in the vault. Similarly, once a pawnbroker issues a loan, there’s no way for them to track down the borrower and repossess the cash in the event of a default. That’s why the collateral margin exists in the first place.

In a way, we can think of Dai as an autonomous asset that has been freed from constraint within the Maker system. There is no counterparty risk, lean, or accrued debt overhang when holding Dai. This separation is crucial because Dai’s entire premise is centered around being a soft-pegged USD stablecoin for commerce and other economic activity. Most of the issued Dai does not remain in the hands of the original vault owner, but is passed to other 3rd parties in exchange for goods or services. Thus, it is not palatable for the system to be able to confiscate it. Dai can only exit the ecosystem if the original vault owner returns the Dai (and pays down associated interest) to recoup their locked collateral.

Liquidation Mechanics

System agents known as keepers, who act as arbitrage agents, continuously scan the blockchain looking for opportunities to initiate liquidations on vault’s whose collateral ratios fall below the mandated threshold, and profit off the ensuing collateral auctions. In doing so, they naturally ensure the outstanding Dai supply remains fully collateralized and solvent. Let’s refer to our previous example.

At time T3 this particular vault’s ETH collateral has fallen to $149, and now subject to liquidation.

Keeper “bites” the vault (queues it for potential liquidation)

Liquidity Providing Contract (LPC) checks the math of the keepers: it queries the MakerDao system for a price quote for the crypto collateral underpinning the vault. The LPC then uses this information to calculate the collateral-to-debt ratio. If the vault is indeed under the required margin, it begins the auction process

LPC applies a liquidation penalty to the total debt (currently 13%)

Vault’s collateral is then issued up for auction, described in the processes below

Flap Auction:

Total vault liabilities: 100 Dai (loan)+ 13 Dai (liquidation penalty)

System is auctioning off 1 ETH collateral with a “target bid” of 113 Dai

Keepers bid for a fixed amount of collateral (1 ETH), with an increasing amount of Dai:

If the target bid is hit, the Flap Auction concludes, and the Flip auction begins

The overwhelming majority of time, the flap auction will hit its target bid, due to how much risk free profit exists

All of the vaults debts (loan + liquidation penalty) have now been paid down

Flip Auction

The objective of the flip auction is to return some of the excess collateral back to the original vault creator by reducing some of the keeper’s risk free profits

With the “target bid” already hit and all outstanding debts paid down, the auction turns into a reverse format. Bidders bid for a decreasing amount of collateral in exchange for the 113 Dai.

The starting bid begins where the flap auction left off: 1 ETH

In the above scenario, the lowest amount of ETH a keeper was willing to accept in exchange for 113 Dai was 0.85 ETH, yielding a risk-free profit of $13.65

The remaining 0.15 ETH is returned to the vault’s creator.

Flop Auction

A flop auction is triggered if the bids from keepers are not high enough in the flap auction to cover the vault’s outstanding debts. This situation is referred to as “bad debt”.

Suppose in the previous flap auction, only 2 keeper bids emerged, neither of which covered the “target bid” of 113 Dai.

This could happen if the price of ETH was crashing tremendously, and keepers were fearful that by the time they were able to sell the ETH on a centralized exchange, it would be worth less than their acquisition price.

In this scenario, the 1 ETH will be sold for 95 Dai to the keeper

The LPC will then pull 18 Dai from the MakerDao system surplus fund to close out the outstanding debt

If the surplus fund is bankrupt, then the protocol will mint MKR from thin air, and auction it off to keepers to recapitalize the system.

In this example, keepers would bid on a decreasing amount of MKR in exchange for 18 Dai.

Stability Fees

Whenever a vault creator looks to return their Dai loan, they must pay the stability fee in order to retrieve their collateral. This fee is equivalent to the interest rate that the pawnbroker charges the borrower when they come to recoup their pawned collateral. The stability fee is transferred into the system surplus fund (as discussed in the next paragraph) where it eventually accrues to MKR holders. Thus, as the MakerDAO ecosystem expands and more Dai is created by vault owners, the price of MKR should scale linearly, as MKR holders benefit in the form of more fees.

System Surplus Fund

The system surplus fund is an aggregated capital pool that acts similar to an insurance fund. Proceeds from the liquidation penalty (when a vault is liquidated) and the stability fee (when a Dai debt is paid down) are sent to the pool. MKR token holders vote on the buffer limit of the fund, i.e. the ceiling limit of capital that ultimately caps its expansion. Once this threshold is hit, any additional proceeds entering the channel are used to buy MKR tokens off the open market, where they are subsequently burned (think of a corporation buying back its stock and then retiring the shares). This in turn pushes the price of MKR up, benefiting the token holders. While the examples below only show fees added to the surplus fund stemming from liquidation, keep in mind this same fee process (currently 6% APR) occurs when vault owners pay down their Dai debt and retrieve their collateral.

The incentive structure commands caution and sound judgement of the MKR holders when defining the buffer limit. A smaller buffer drives token prices higher in the short term, but in the event of a volatile market downturn, it is these same MKR holders that suffer the consequence of token dilution during a flop auction if vaults were to accrue bad debt.

Dai Stability Rate

Dai holders can stake (lock up) their Dai in a special contract where it will automatically begin accruing interest. This interest is called the Dai Stability Rate (DSR) and is a variable interest rate subject to future alteration. MKR governance voters vote on a regular basis to adjust the DSR in response to various market conditions. The interest rate paid to staked Dai is financed by the stability fee, and comes out of the system surplus fund. Thus, the stability fee must be greater than the DSR in order to finance the program.

One might question the functionality of the DSR, as it seems to be a meaningless tax on vault creators. In proof of stake based systems, staking provides a useful service as a means of securing the network from 51% attack, as well as fair methodology to allocate new tokens stemming from inflation. However, the DSR is not financed via inflation, but is a direct monetary transfer from vault creators to Dai stakers (who are not providing any value-added contribution to the protocol by staking their Dai).

The Dai stability rate (DSR) is a policy tool utilized by the MakerDao system help maintain the $1 price peg. It is a tool somewhat similar to the Fed Funds Rate utilized by the Federal Reserve when establishing key monetary policy. When the market price of Dai starts to deviate from its $1 target peg, MKR token holders can alter certain parameters of the DSR in an effort to re-establish the peg. For example, say the DSR interest rate was 5% and the price of Dai started climbing to $1.05. MKR holders could choose to slash the DSR, which would decrease the incentive to hold Dai, given the lowered yield. This would in turn cause individuals to sell, pushing the price of Dai back down.

Unfortunately, the DSR is not an end-all policy tool. The MakerDao system inherently lacks the closed-loop arbitrage mechanisms that other stablecoins like USDT or USDC possess, due to the fact that the model requires overcollateralization of the underlying asset. Cryptoasset researcher Hasu describes this dilemma in depth in this article

Oracles

Recall that the Maker system needs to query price quotes for the underlying collateral assets in order to establish liquidation ratios. But how does it access such information natively? Enter oracles. Oracles are key ecosystem participants that make off-chain data (i.e. data that doesn’t natively exist in the MakerDao system) available as inputs for contracts on-chain. An oracle could be as simple as 1 person scraping API price feeds for a specific token from Coinbase, and publishing that data in a transaction within the Maker system. With that off-chain data “imported” onto the Maker blockchain, the system can utilize that information to manage Vaults.

However, these oracles have the potential to become a central point of failure. Suppose the oracle is exploited and pushes a price of $0.01/ETH. Every vault would be liquidated by the system. Conversely, if it published a price of $100,000/ETH, vault owners could issue themselves unlimited amounts of Dai, without having the corresponding crypto collateral to back it. The methodology of constructing and securing oracles is arguably the most important component of the Maker system.

The oracle system is decentralized methodology of reporting price data. Feeds are individuals or organizations elected by the community to pull data from various centralized exchanges by manner of a strict protocol. We can think of these feeds as nodes, and they perform reporting duties by running a node software called Setzer. Currently there are 20 different feeds.

Setzer comes preconfigured with a list of “whitelisted” centralized exchanges to pull price data from. Feeds will select n exchanges according to their choosing, and Setzer will automatically query the exchanges’ API to retrieve latest price quote. Each feed will then compute the median value of all queried prices. It then transfers all this data over an encrypted peer-to-peer messaging communications channel called scuttlebug, where the data from all 20 feeds can be aggregated. Scuttlebug is useful because it saves the system considerable time lag and fees due to the fact that it is taking place offchain, and thus not subject to high transaction fees or latency.

Another group of network participants called relayers are constantly monitoring scuttlebug. Relayers will aggregate the 20 median values sent by the feeds, and send them to a smart contract on the blockchain called the medianizer.

From there, the medianizer takes the median value of those 20 median prices. After computing the median of the medians, the medianizer publishes this final figure as the queued reference price.

This queued reference price is then picked up by another module called the Oracle Security Module (OSM). The OSM price doesn’t really alter the queued reference price, it merely locks in the data and then delays it for a specified period of time. Once that time has passed, the Maker system will utilize this OSM price as the “authentic” price to be applied to Vault analysis. Thus, the price feeds in the Maker system lag the centralized exchange price, due to the OSM freeze. This freeze was implemented because it provides a last line of defense for the oracle system. Say an attacker was able to exploit numerous centralized exchanges at once, or compromise enough feed nodes to somehow push an egregious value into the OSM. A procedure exists called an emergency shutdown feature that allows MKR holders to freeze the system, allowing Dai holders to withdrawal their capital from the corresponding vaults. MKR holders can recognize this because the OSM shows the next queued price before it gets implemented into the official slot, and the delay period allows enough time for the governance holders to gather and act accordingly.

Maker Valuation Model

Fee based revenue can accrue to the Maker token, which allows for tokens to accrue value similarly to traditional equity assets. Our analysis includes a discounted cash flow (DCF) model to arrive at an intrinsic value. As shown in our model below, following our base case assumptions and projections for fee based revenues, the intrinsic market value of the MKR token network is $6.43bn--3x valuation from current levels.

Conclusion

The MakerDao protocol is a unique system where users can deposit crypto collateral and in exchange, retrieve a decentralized stablecoin. The system is primarily utilized by individuals looking to gain margin on their spot collateral. For example: if you own ETH and are extremely bullish, you can post your ETH into a vault, take the corresponding Dai that is minted, and go sell it on an exchange for more ETH, thus generating leverage in the process. If ETH appreciates in that time window, you can sell some of it later to repay your outstanding Dai debt and recover your initial collateral.

The MakerDao token (MKR) presents an interesting token design in which value should theoretically accrue to token holders as the network grows due to the profits made off stability fees and liquidation penalties. Unlike many other cryptoassets, the MakerDao protocol produces revenue streams from its operations, making it possible to apply a DCF valuation framework to the MKR asset. The drawback is that it is difficult to predict the impact of black swan volatility events, which could leave MKR holders as the “buyers of last resort”, devastating token price in the process. While there has been only one recorded instance of such scenario, the inherent volatility of the cryptoasset landscape makes the scenario seem almost inevitable at some future point. How big of an impact such a volatility event would have on the MKR token is difficult to assess.

Despite these inherent risks, the growth of the MakerDao protocol in recent months has been impressive. The natural expansion of the cryptomarkets at large, along with increased interest in permissionless and censorship resistant stablecoins, it is hard to deny the continued growth of the MakerDao platform.

Disclaimer

We do not endorse or recommend any investment action in the MakerDao token (MKR). This document should not be regarded as investment advice, offering document, or as a recommendation regarding a course of action.

Very thoughtful analysis. Good call.